BUSINESS & FINANCE | LATEST NEWS

7 Reasons Holding Cash Is Making You Poor (And What to Do Instead)

Reviewed by Sach Kukadia

Last updated: May 2nd, 2025

Last updated: May 2nd, 2025

Jeffrey Gundlach,

CEO of DoubleLine Capital

With Gold You Will Make It

"Gold continues its bull market that we've been talking about really now for a couple of years ever since gold was down to $1,800... I'd be so bold to say I think gold will make it to $4,000."

You’re not “playing it safe.” You’re bleeding value. Here’s why doing nothing is the most expensive decision you’re making - and why switching to physical gold, right now, is the smarter move.

SHOP GOLD

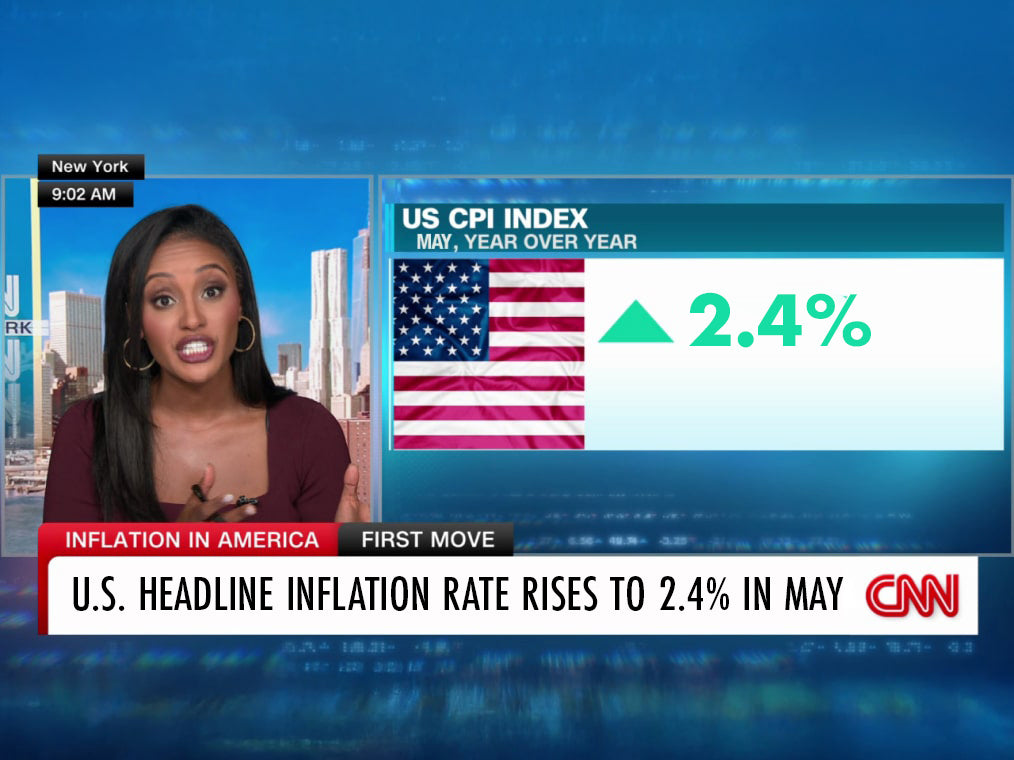

1. Inflation Has Just Robbed You Blind

Yeah, inflation's currently at 2.4% - but that’s only because it already spiked above 9% in 2022. That wasn’t a warning shot. That was a wealth transfer. If you held cash through that?

You lost nearly 1/10th of its value. Quietly. Permanently.

FEATURED IN THIS ARTICLE

Don’t let your money rot away in the bank.

Invest Smart

We invite you to re-envision wealth as something to be worn, to be appreciated as it appreciates - an elegant shield against uncertain times. We invite you to invest in the sustainable stability of 999 Platinum and 24 karat Gold jewellery.

As Seen On

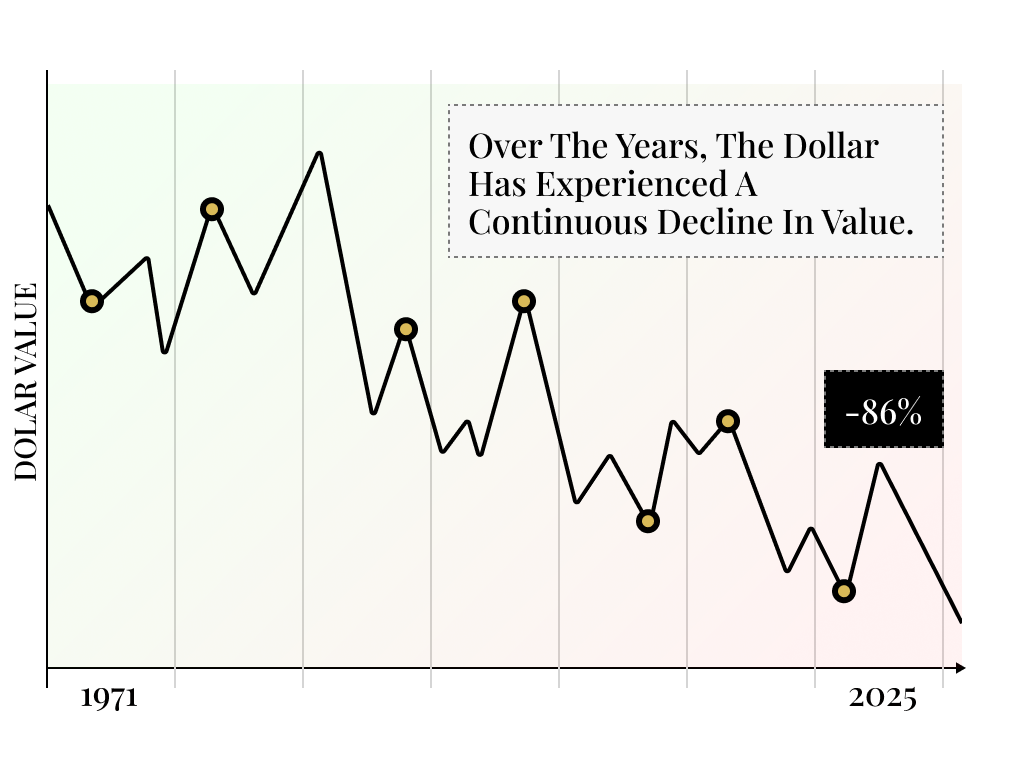

2. The dollar Has Lost 86% of Its Value Since 1971

The U.S. dollar’s purchasing power has been in steady decline since it was decoupled from gold. Meanwhile, gold has appreciated over 5,600%. This isn’t theoretical. It's a direct consequence of currency devaluation through systemic money printing and debt expansion.

3. Gold Outperforms When Markets Are Under Pressure

Gold has a documented history of preserving value during recessions, geopolitical instability, and market volatility. In every major downturn, from the 2008 financial crisis to the 2020 pandemic response, gold moved in the opposite direction of risk assets - protecting capital while equities corrected.

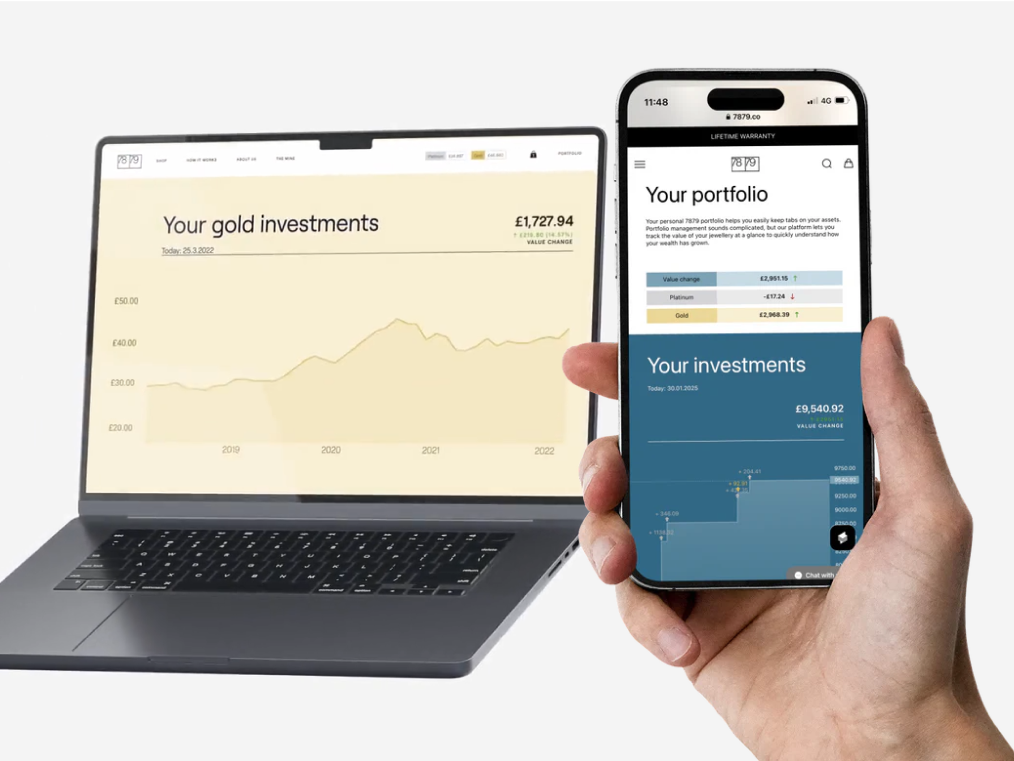

4. 7879 Turns Gold Into a Liquid, Wearable Asset

7879 offers 24k gold and platinum in their purest form - priced by weight and tracked in real time. These pieces function as physical bullion, only wearable. The value is transparent, the ownership is tangible, and the liquidity is built in.

5. Full Buyback Guarantee Makes It a Flexible Asset

Every piece comes with a buyback policy at market rates. That means no guesswork or resale friction. You can exit when it makes sense - without relying on volatile third-party markets or auction platforms.

6. No Ongoing Fees, No Intermediaries, No Carry Costs

There are no fund managers, no annual charges, and no storage fees. Unlike most financial products, there’s no erosion of returns from ongoing costs. You buy the asset once and own it outright.

7. Holding Cash Means Accepting Loss, Passively

In a post-QE, high-debt, deglobalizing world, fiat currencies are structurally compromised. Allocating a portion of capital into physical gold isn't speculative - it's defensive. It’s a move away from erosion and toward resilience.

“This isn’t about trends. It’s about capital preservation through a volatile decade”

Gold doesn’t require belief - it operates on history, scarcity, and logic.

And when it’s wearable, liquid, and verifiably priced? It stops being niche.

It becomes the most practical asset in your portfolio.

More Than 11,000+ Customers Already Trust Us

Theo

Hooked On Platinum Now

Just got my platinum pendant, and I’m in love! It looks amazing, feels substantial, and is now my everyday go-to. Customer service was awesome—they applied my discount after I forgot to use it. Can’t wait for my next purchase!

Willow

Compliment receiver

Bought two beautiful pieces of gold jewelry from 7879. I wore them to girls' night, and you wouldn’t believe how many compliments I got—they were a total hit! The quality and shine are just amazing; I already know these will be my favorite go-to accessories.

Leo

Exactly what I was looking for

After doing a bunch of research online looking for Quality jewelry, reading review after review, I decided that one of the best values out there today is 7879. I’ve purchased several items so far, and I have been extremely happy with the customer service as well as the items I’ve received.

Victor M.

7879 is straight forward and transparent

An investment that I wear and enjoy daily.

Suzana

It’s a pleasure to see a brand that does what it says

Fantastic products - and you will never get pure 24k gold jewellery anywhere else. The markup is very acceptable max 30-38% more than the international market price in bullion terms. Basically you are wearing really perfect priced investment jewels.

Lilly

Really happy with my recent 7879

Excellent quality and already receiving so many comments when I'm wearing chain. Would definetly purchase more pieces again.. It's an investment after all so a justifiable treat!

George

Surprisingly good quality and great service

Great quality chain, which I struggled to find elsewhere It arrives nicely packaged and includes purity certificates. There's plenty of choice good value & excellent service.

William

Very Happy

7879 gold jewelry is top quality, mad price for quality. Looking fly and getting compliments everyday.

Lucia

Beautiful and Iconic for Reasonable Price

Beautiful, classic and no nonsense 24k gold necklace and pendant by 7879. Arrived so quick and has been legitimately check by my local jeweller to be what it says on their website. Plus the price in gold weight/gram and the labour cost is also presented together with the value of your items as an investment.